6805 Lakewood Drive

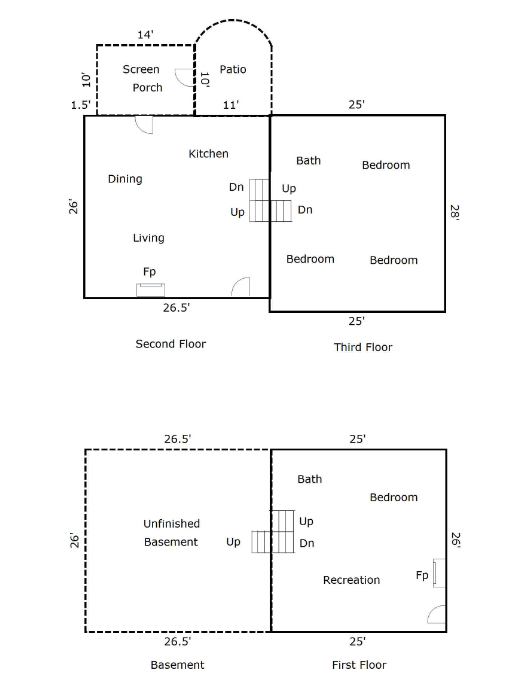

The spacious tri level style house on .52 acres at 6805 Lakewood Drive has an unfinished basement with approximately 689 sq. ft., a 14'x10' screen porch, a concrete patio, and a driveway with space for 2-3 cars.

At a Glance

|

Living Space |

Year Built |

|

Rooms |

Cooling |

|

Bedrooms |

Heating |

|

Bathrooms |

Parking |

|

Fireplaces |

Lot Size |

Interior Features

- Flooring: Hardwood, LVP

- Light: Large windows, partial shade

- Appliances: Range

- Floorplan: Spacious tri level with basement

Exterior Features

- Siding: Brick, cement plank

- Style: Split level

- Roof: Composition

- Foundation: Partial slab, block

Costs

- Appraised Value: $371,000 (2022 appraisal | buyer pays 50% appraised value of the home plus the buyer's share of renovation* costs | Minimum Purchase Price $185,500)

- Down Payment Minimum $18,550 PLUS closing costs

- Estimated Annual Tax: $3,292.05

- Monthly Land Use Fee: $100

- Deposit due with Letter of Intent: $1,000

The University is offering a match for qualified renovations*, up to $55,650.

If the buyer does not complete any additional renovations, the purchase price would be $185,500.

The minimum downpayment due at close is 10% the purchase price.

$18,550 would be due at close.

Example with renovations:

If the buyer's share of renovations is $40,000, the purchase price would be the purchase price PLUS the buyer's share of renovations ($185,500 + $40,000), so the purchase price would be $225,500.

In this scenario, the downpayment due at close would be $22,550.00

How does the match for qualified renovations work?

UR will put up to 15% of the home’s last appraised value into repairs and renovations (home budget).

Necessary repairs as identified on a home inspection will be completed prior to renovation and draw from that amount (necessary repairs).

Approved changes and renovations will then be split 50/50 up to the remaining amount in the home budget (remaining home budget). If homeowners wish to spend more than would be matched on renovations, they may. The maximum UR contribution for repairs and renovations will be $55,650.

Next Steps & Policies

-

How are homes offered?

Homes are offered to individuals on the interest list- those with the longest continuous service to the University are given right of first refusal for properties we offer.

If you have been presented with an opportunity to purchase, you will be asked to either express interest or pass on the property within 2 days. If we receive no response, we will move on and offer the home to the next individual on the list.If you have a more recent hire date, consider this program a long-term opportunity.

-

Who is eligible?

Full-time faculty and staff are eligible to purchase a University-owned home. When a home becomes available, we reach out to individuals on our interest list to let them know the home will be listed on SpiderBytes. The home is listed on SpiderBytes and the interest list is opened for that home. We organize the interest list by hire date- those with the longest continuous service have the right of first refusal and so on.

-

How is the sale price determined?

The sales price is 50% the appraised value as determined by the University plus the buyer’s share of renovation or construction costs (when applicable) -

How is the buyer’s share of the price determined?

-

How long can I stay in the home?

As long as you remain a full time employee of the University, you are eligible to remain in the home. The University’s goal is to have long term tenants for all of the properties that we offer for sale.

If you leave the University’s full time employment (move, retire, become part time, or quit) you have 60 days (2 months) to sell the property back to the University. If you pass away, your surviving spouse has 5 years from the date of your passing before they must sell the property back to the University.

The University has the right to terminate the lease and demised term at any time for any reason by providing the tenant no less than 24 months (2 years) prior written notice.

-

What financing is available?

The University offers 15 and 30 year fixed rate mortgages to buyers and requires a minimum of 10% down. The rate is determined by the University.

-

What will my monthly expenses look like?

In Box folder you will find an excel document with “Cost Estimate Scenarios” that lists estimated monthly expenses.

Please also consider 1 -time expenses like closing costs, which are the responsibility of the buyer and based on the value of the home as determined by the locality.

-

Who maintains the property?

As with a traditional home purchase, the buyer is responsible for the property after the sale of the home. Any substantive changes to the property or surrounding area require approval from the University prior to implementation. -

When will I be offered a home?

When a home becomes available, we reach out to individuals on the interest list by hire date- those with the longest continuous service have the right of first refusal and so on.

Due to the nature of the process it is difficult to predict when a home might become available or when a property might be offered to a specific individual. -

Are there any policies I should be familiar with?

If you are interested in purchasing you should familiarize yourself with Policies in the Box folder.

Before you express interest please read:

PRM-2001 – Policy for Management and Use of University-Owned HousesIf the University has pre-approved improvements to a home, please read:

FIN-4403 Procurement Policy